- India

- International

Question mark on government wheat output estimates of 94 mn tonnes

Overall wheat arrivals in mandis have been only 25.29 mt so far this marketing season, as against 30.49 mt during the same period last year.

When both procurement and mandi arrivals are down by over 5 mt, many grain traders and analysts are asking how production can be 7.5 mt more than 2014-15.

When both procurement and mandi arrivals are down by over 5 mt, many grain traders and analysts are asking how production can be 7.5 mt more than 2014-15.

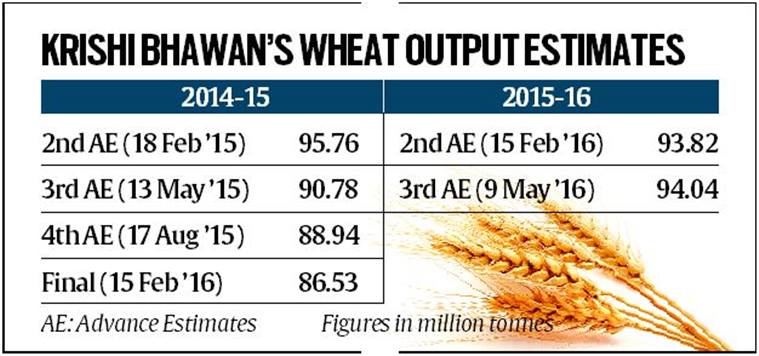

Huge question marks are being raised over the Centre’s wheat production estimate of 94.04 million tonnes (mt) for 2015-16, which is significantly higher than the previous year’s figure of 86.53 mt.

The agriculture ministry’s output numbers are being taken with more than a pinch of salt on many counts. The first has to do with procurement and market arrivals. Government agencies have till now procured only 22.84 mt of the 2015-16 crop in the ongoing rabi marketing season (April-June) and that figure is unlikely to cross 23 mt. This is not just below the target of 30.5 mt, but even the 28.09 mt procured last year.

Even overall wheat arrivals in mandis have been only 25.29 mt so far this marketing season, as against 30.49 mt during the same period last year. When both procurement and mandi arrivals are down by over 5 mt, many grain traders and analysts are asking how production can be 7.5 mt more than 2014-15.

Radha Mohan Singh Interview: ‘Doubling farm incomes is our priority’

Agriculture ministry officials declined to comment on the current official production estimates.

“It seems this government is overanxious to show that the farm sector is booming, when that is hardly the case,” said Ashok Gulati, former chairman of the Commission for Agricultural Costs & Prices. Interestingly, in 2014-15 also, the agriculture ministry had originally reckoned the crop’s size at 95.76 mt — marginally lower than the record 95.85 mt achieved in the last year of the UPA regime — before eventually revising it down to 86.53 mt.

But for 2014-15, the initial high estimate was made in February 2015, before the large-scale damage to the standing crop from unseasonal rains and hailstorms had taken place. This time, it is the opposite: the first advance estimate pegged production at 93.82 mt. The second estimate, released earlier this month, has revised it further upwards to 94 mt-plus (see table).

“It isn’t clear how they have arrived at 94 mt. Our assessment is that it would be between 84 to 86 mt,” said a top executive from a leading multinational grain trader and branded atta maker.

His views were seconded by the representative of a major domestic commodity trading house: “The government’s own data shows the country’s wheat acreage to have fallen from 31.47 million hectares to 29.09 million hectares this year. Even with average per hectare yields of 3 tonnes — which seems difficult given the very poor soil and sub-soil moisture levels, aggravated by high temperatures and absence of winter rains — you get only around 87 mt.”

An equally important reason to doubt Krishi Bhawan’s estimates relates to prices. “Last year, I was getting wheat from Rajasthan and Madhya Pradesh at Rs 1,640-1,650 per quintal and from Uttar Pradesh at Rs 1,750 through April-May. This time, prices started at Rs 1,840-1,850 and have now hit Rs 2,000 per quintal. If production is higher, why should prices go up, that too during the marketing season?” said S Pramod Kumar, executive director of Sunil Agro Foods Ltd, a Bangalore-based flour miller.

Wheat is currently wholesaling in Delhi at about Rs 1,700 per quintal. Even in central UP mandis such as Etah, Bareilly, Shahjahanpur, Hardoi, Sitapur and Kanpur, prices are ruling above Rs 1,600 per quintal. “Unlike last year, when farmers were desperate to sell at the minimum support price (MSP), we are now in a seller’s market. After many years, market prices have actually gone above the MSP of Rs 1,525 per quintal during the season itself,” observed the MNC executive.

One casualty of the Centre’s wheat output and procurement overestimation may be stocks with the Food Corporation of India (FCI). These are likely to dip well below 30 mt by end-June and just over the minimum buffer norm of 27.58 mt for that date. “There will not be enough wheat available under the FCI’s open market sale scheme this time. The Centre should cut the import duty from 25 to 10 per cent, which will allow us to contract overseas wheat and reduce pressure on domestic supplies,” said Kumar.

The landed cost of Australian prime white wheat at Chennai or Tuticorin ports will now work out to $240-245 or Rs 16,200 per tonne. Black Sea origin wheat from Ukraine, Russia, Kazakhstan, Bulgaria or Romania is available even cheaper at $205-210 or Rs 14,000 per tonne.

Apr 26: Latest News

- 01

- 02

- 03

- 04

- 05