Microsoft's transition from traditional software to the cloud is picking up steam

Last summer, I looked at how the three biggest tech companies -- Apple, Google, and Microsoft -- had evolved over the years.

Since then, not much has changed at Apple except for the size of its phones (increasing, just like its stock price). Nor has Google's dependence on advertising changed in the past year.

But Microsoft as a company has continued its dramatic transformation, which is starting to show up in the numbers. It all started with Steve Ballmer's "devices and services" vision, which has slowly morphed into "mobile first, cloud first" in the past two years.

Regardless of the tagline, the idea was to move away from traditional software licensing and toward cloud-based services that can run on any device.

Historically, Microsoft's business model has been based on selling software licenses. In fiscal 2004, roughly 82 percent of all Microsoft revenue came from licensing Windows, Windows Server, and Office.

Ten years later, at the end of fiscal year 2014, Microsoft's reliance on traditional software licensing was still high, at just over 70 percent, with the company's big investments in cloud services and hardware beginning to bring in substantial revenue.

More importantly, revenue from Windows desktop licenses is diminishing quickly as the average price drops, although it's still a crucial part of the company's platform strategy.

At the end of this month, Satya Nadella will conclude his first year as CEO, and a few weeks later Microsoft will report results for fiscal year 2015. If current trends continue, it looks like the company will show dramatically increased revenue overall, with less than 60 percent of total revenue coming from traditional licensing.

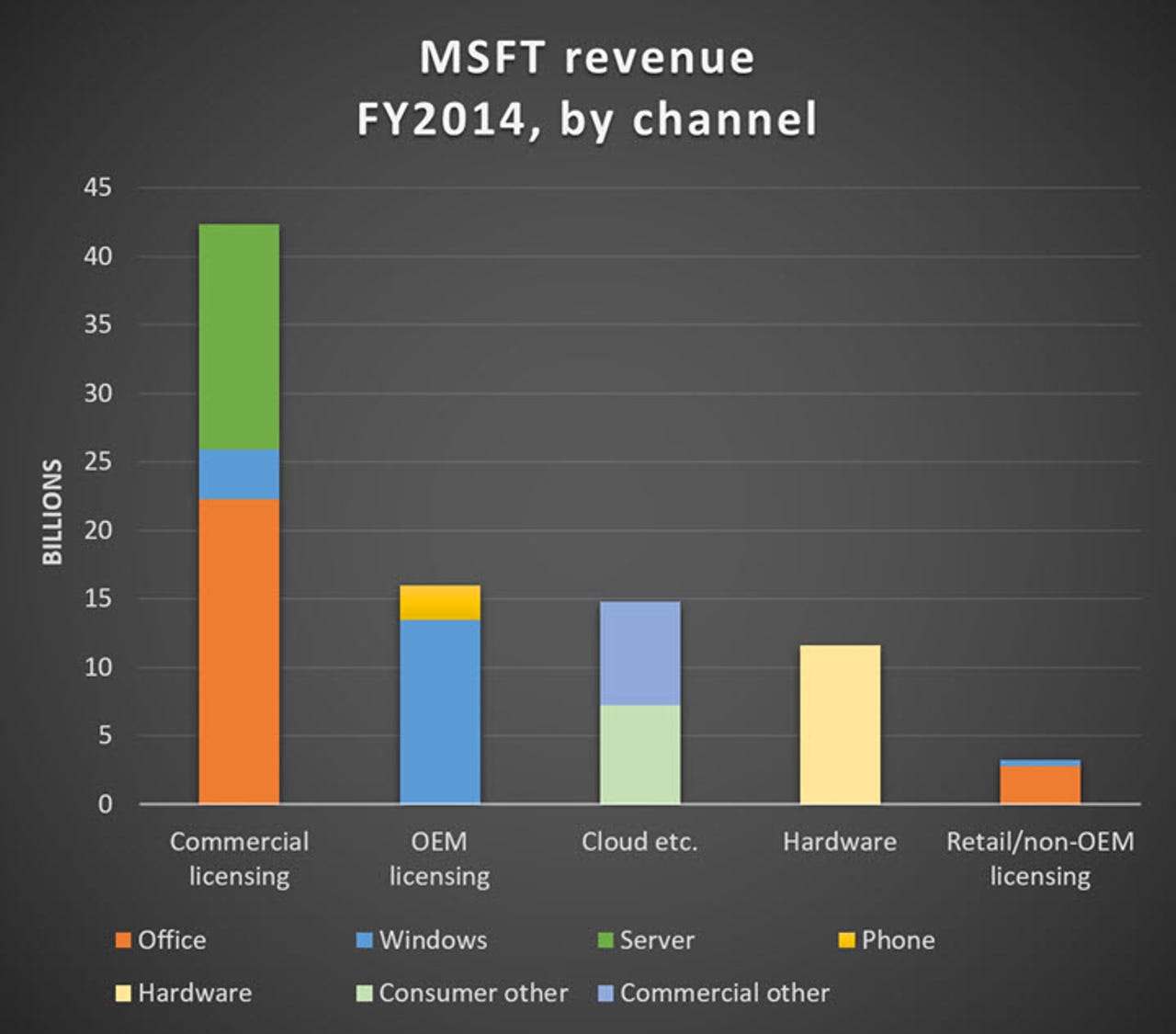

This is what Microsoft's business looked like a year ago, using reported revenue for the fiscal year ending June 30, 2014.

A few observations from this chart. Reading from left to right:

- Big companies are the core of Microsoft's business. The amount of revenue from commercial licensing dwarfs every other category, mostly from Microsoft Office and server products like Windows Server and SQL Server. Volume licensing for Windows desktop editions contributes a meaningful chunk of revenue.

- In 2014, OEMs paid $13.5 billion for the right to put Windows on PCs. The revenue in the Phone category includes some very big patent licensing checks from makers of Android devices.

- The Commercial Other category consists mostly of Office 365 Commercial and Microsoft Azure revenue. The Consumer Other segment includes Office 365 Personal and Home subscriptions as well as transactions from the Windows Store, Xbox Live, and online advertising. Those two segments are more or less equal in the category I call Cloud etc.

- Hardware includes all of Microsoft's keyboards and mice, but the biggest contributors by far are Microsoft Phone, Xbox, and Surface products.

- If you look very closely at the top of the last bar you can see a tiny sliver of blue. That's how much Microsoft made from retail sales of Windows, both full copies and upgrades. It is a microscopic business, and it explains why Microsoft is eagerly giving away Windows 10 upgrades to consumers and small businesses.

Now look how 2015 is shaping up. I pulled these numbers from the most recent 10-Q report which included details for the nine months ending March 31, 2015. There's another full quarter to go before the totals can be compared with 2014, but some trends are already appearing.

Again, reading from left to right:

- The Commercial Licensing category is still doing well, with Windows desktop licenses already ahead of last year and server revenue looking on track to increase slightly. The sharp drop in the Office slice is a direct result of transitioning commercial customers to Office 365 Enterprise plans.

- OEM licensing is down, which reflects a dramatically lower average price per device. Some Windows licenses are now free or nearly so; in addition, sales of (more expensive) Pro licenses are down compared to last year, when there was an artificial bump caused by the end of support for Windows XP.

- The cloud business is well ahead of last year's pace, with the commercial segment doing especially well. Much of the growth in commercial cloud is from Office 365 migrations.

- In three quarters this year, the Hardware group has already blown past its total revenue for last year and is on track to be bigger than the entire cloud business and much larger than the OEM licensing business. That's revenue only, of course. Margins in the OEM licensing business are sky-high, whereas profits are much harder to come by in the hardware business, unless your device has the Apple logo on it.

- Retail business? What retail business? With dirt-cheap Office 365 consumer subscriptions (many included with new PCs) and free Windows 10 upgrades, It's likely that this segment will be just a sliver next year.

I'll be looking eagerly at the fiscal year-end numbers when they're published at the end of July. I fully expect several of these trends to accelerate, and it will be interesting to see whether Microsoft begins revealing how many Surface devices it sells, the way it currently reports Xbox and Lumia smartphone unit sales.

And of course, we'll find out how well or poorly the Microsoft Phone division is faring, with the possibility of a major write-off of the Nokia Devices acquisition.