The Federal Reserve is going to take its sweet time raising interest rates. And the market couldn't be happier.

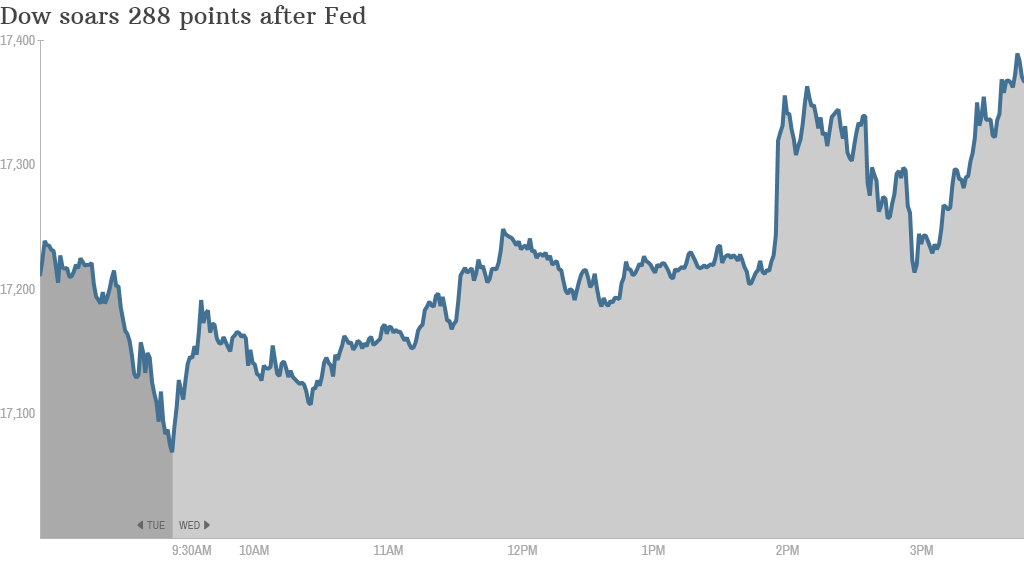

The Dow and S&P 500 had their best days of 2014. The Dow surged 288 points.

The central bank said Wednesday afternoon that it would be "patient in beginning to normalize the stance of monetary policy" and added that this new language is consistent with earlier statements that it plans to keep interest rates low for a "considerable time," which it also kept.

Oh J-A-N-E-T, I love you so. Investors had been hoping the Fed would keep the "considerable time" phrase in its statement. By doing so, it appears that the Fed is signaling that it is unlikely to begin raising interest rates until sometime in the summer of 2015 or later.

During a press conference, Fed chair Janet Yellen said that the Fed may not move to raise rates until after a "couple of meetings" next year.

"I believe the dictionary says a couple means two," she added.

As she has done repeatedly since taking over as Fed chair, she stressed that any change in policy will depend on the economic data.

Related: The hottest stocks of 2014

"Investors were concerned that the Fed may move too quickly. But it looks like the Fed is not going to raise rates until the second half of 2015," said Ronald Sanchez, chief investment officer with Fiduciary Trust Company International.

Bond investors aren't convinced that the Fed is ready to put on its rate hiking boots either. The yield on the 10-Year Treasury is currently hovering around 2.15%.

That's near the low point for the year. Bond rates should eventually move higher once the Fed starts tightening monetary policy.

It's interesting to note that three Fed members dissented from today's decision, a reminder that there's still some debate about what will happen next year.

How we got here. The Fed slashed interest rates to near zero in December 2008 at the height of the Great Recession and has kept them there ever since in an effort to stimulate the economy.

But the central bank started to cut back on its crisis-era bond purchase program, known as quantitative easing or QE, earlier this year as the economy improved.

In October, the Fed finally ended QE.

Related: Where stocks are headed in 2015

That's why much of the focus on the Fed this year has revolved around the timing of its next interest rate increase.

The last time the Fed hiked rates was way back in June 2006.

When will the Fed raise rates? Some of the recent stock market volatility could be attributed to concerns that the Fed could push up the first rate hike to the spring because of the improvement in the job market and other parts of the economy during the past few months.

But oil and gas prices have plunged lately. As a result, consumer prices rose at their slowest rate in nearly six years last month. The Fed said Wednesday though that it expects the impact of lower energy prices to be "transitory."

Yellen acknowledged that the rate of inflation could remain low for awhile because of what's happening with oil prices but that prices should move back up over time.

"From the standpoint of the U.S. and U.S. outlook, the decline we've seen in oil prices is likely to be, on net, a positive," she said.

The global outlook: But while America benefits, not all countries are so fortunate. Yellen did note the "very difficult economic conditions" in Russia due to the drop in oil prices and devaluation of its ruble currency. She said the Fed discussed the possibility of Russia's problems hurting the U.S. economy but she concluded that any spillover would be minimal.

Investors seemed to appreciate that as well.

"The Fed has shown a lot more sensitivity to the market and global backdrop than they have done in the past," said Robert Tipp, chief investment strategist with Prudential Fixed Income. "It's encouraging that the Fed seems to be taking into account the drop in inflation and financial conditions."

Related: There basically is no inflation

The Fed has long maintained that its goal is for annual inflation of around 2%. Overall consumer prices are up just 1.3% during the past 12 months.

Even when you toss out volatile energy and food prices, the so-called core inflation rate is 1.7% -- still below the Fed's target.

The Fed also released new economic projections on Wednesday. Fed members slashed their inflation outlook for 2015, but they expect the economy to grow more next year, and they indicated that they expect the unemployment rate to fall even further than originally expected.

One strategist said that continued improvement in the job market will outweigh any fears about lower oil prices and deflation for the Fed.

"You have to distinguish between good inflation and bad inflation. The Fed is more worried about wage growth being too slow. But that's growing and accelerating," said Brad McMillan, chief investment officer for Commonwealth Financial.