Briefing highlights

- What's hot and not in Canada's home markets

- Stocks tumble across the globe

- Delta in big order for Bombardier planes

- Potash Corp. tumbles on weaker outlook

- Bank of Japan disappoints investors

- Video: How to say no to more work

Frothy vs. flat

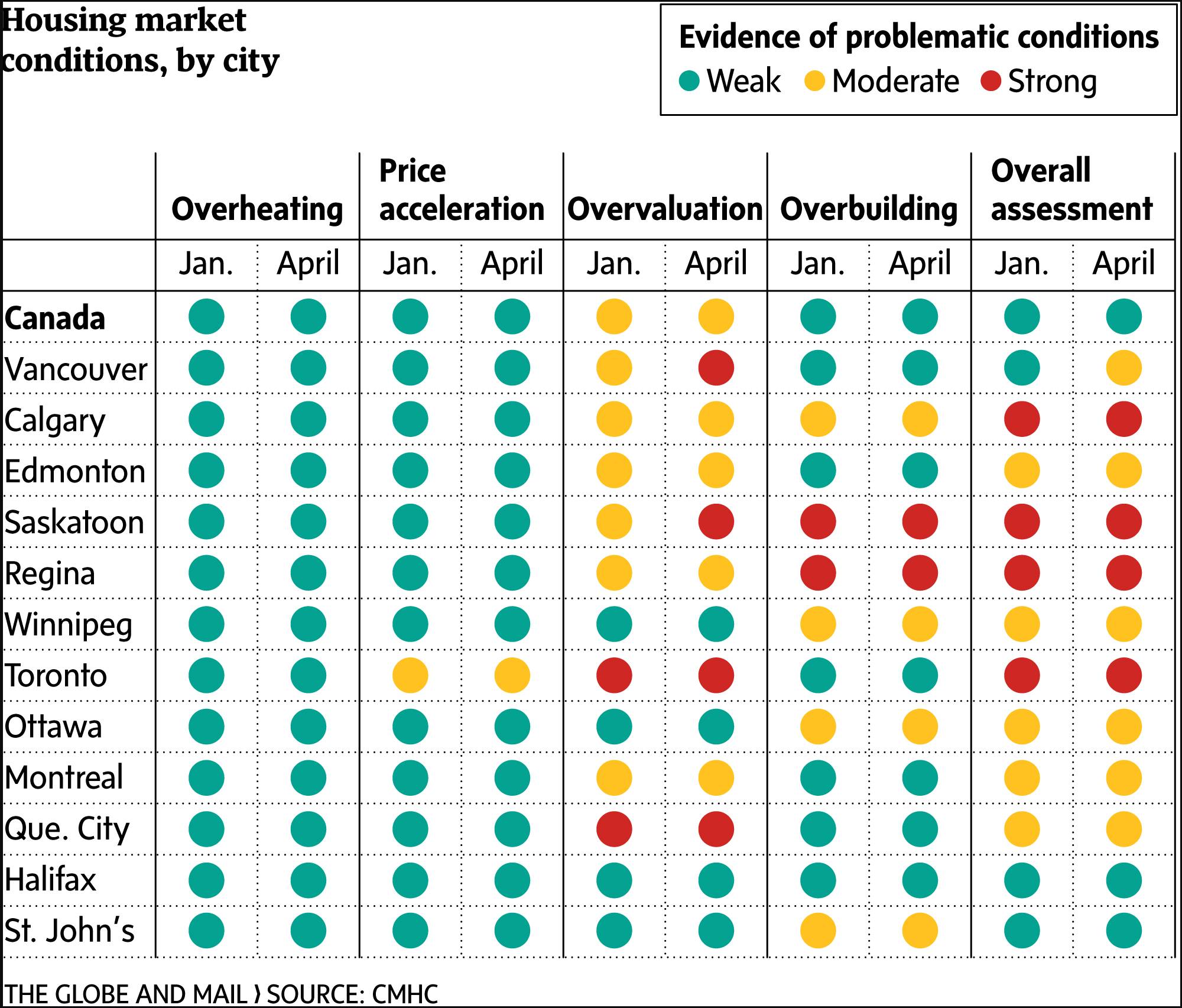

CMHC’s quarterly study on what’s hot and what’s not highlights how many residential real estate markets are more hot than not.

As The Globe and Mail’s Tamsin McMahon reports, Canada Mortgage and Housing Corp. flagged 10 of 15 markets for various measures and, for the first time, warned that Vancouver was looking frothy.

That’s no surprise to many observers who have oft warned of overvaluation in Canada’s two hottest markets, Vancouver and Toronto.

Other analysts, though, have said there’s no big trouble on the horizon in those two cities because both are creating jobs and both have a healthy level of household formation.

The national housing agency looked at four areas: Overheating, measured by the ratio of sales to new listings; price acceleration based on average prices; overvaluation based on average prices and new housing indexes; and overbuilding, based on rental vacancy rates and the stock of completed and unsold condos.

Here’s a look at what CMHC found in 15 major markets in its second-quarter report, from left to right:

Victoria: “Overheating, price acceleration and overvaluation in the housing market show weak evidence of problematic conditions. We detect weak evidence of overbuilding as newly completed homes were sold and rental vacancy rates remained low.”

Vancouver: “The change in our overall assessment from the previous quarter was mainly influenced by a shift from moderate to strong evidence of overvaluation, indicating that home prices are above the level supported by economic and demographic fundamentals. The remaining indicators assessed continue to suggest weak evidence of problematic conditions.”

Calgary: CMHC detected “strong evidence of problematic conditions, due to a combination of moderate evidence of overvaluation and overbuilding. A deterioration of economic fundamentals have contributed to moderate evidence of overvaluation.”

Edmonton: “We detect moderate evidence of problematic conditions in Edmonton’s housing market. Factors such as overheating and price acceleration continue to show weak evidence of problematic conditions.”

Saskatoon: There’s “strong evidence of problematic conditions.” CMHC found “weak evidence” of overheating and price acceleration, but “strong evidence” of overbuilding.

Regina: “We continue to detect strong evidence of problematic conditions in Regina’s housing market. There’s “weak evidence of overheating and price acceleration, but “strong evidence” of overbuilding. And slower income growth makes the case for “moderate overvaluation.”

Winnipeg: “We continue to detect moderate evidence of problematic conditions, due to overbuilding in the ownership market. Improvements to economic fundamentals, such as growth in full-time employment and disposable income, have contributed to reduce concerns of overvaluation.”

Hamilton: Despite the fact that this is one of Canada’s hottest markets, there’s “weak evidence” of price acceleration and overbuilding, but “moderate evidence” of overvaluation. And “the sales-to-new-listings ratio remained above the 75-per-cent threshold used to determine evidence of overheating.”

Toronto: No surprise that CMHC found “strong evidence of problematic conditions.” There’s “strong evidence” of overvaluation, “moderate evidence” of price acceleration, and “weak evidence” of overheating. And “while we do not detect overbuilding, we have some concerns about the high inventory of completed and unsold condominium apartments.”

Ottawa: There’s “moderate evidence” of overall trouble and overbuilding - the latter is because of condos again - and “weak evidence of overvaluation as price growth has moderated.”

Montreal: CMHC found “moderate” evidence of overall trouble and overvaluation and “weak evidence” of overbuilding, while in the resale market “supply remained rather high relative to demand, such that evidence of overheating and acceleration in the growth of prices was weak.”

Quebec City: There’s “moderate evidence” of trouble, with overvaluation coming in as strong, but just about everything else okay. On overvaluation, the findings “were due to the recent shrinkage of the pool of first-time home buyers (aged from 25 to 34) and the modest increase in disposable income per capita.”

Moncton: Little trouble here, just a yellow flag for overbuilding.

Halifax: No trouble here. “Strong international migration gains in the third and fourth quarter of 2015 mitigated the signs of overvaluation despite weak average earnings gains and employment creation.”

St. John’s: Go east, young man. Little trouble, though overbuilding came in as “moderate” while “excess supply of existing home inventory has kept overheating and price acceleration in check.”

A comment I'd love to hear ...

“I was born in Alberta, she was born in Texas. Can I interest anyone in a pipeline?”

Bombardier strikes deal

Delta Air Lines is giving Bombardier’s C Series program a major boost, with a multibillion-dollar order.

The U.S. airline and the Canadian plane and train manufacturer said today that Delta has ordered 75 aircraft, with options for 50 more.

The firm order is worth about $5.6-billion (U.S.), they said.

Bombardier also posted first-quarter results, slumping to a loss of 7 cents a share (Canadian) from a nickel profit a year earlier, while revenues slipped to $3.9-billion from $4.4-billion.

Potash sinks

Shares of Potash Corp. of Saskatchewan slumped today after a drop in profit and a cut to its forecasts and spending.

The Canadian company posted a drop in first-quarter profit to $75-million or 9 cents a share, which includes a $52-million charge, down from $370-million or 44 cents a year earlier.

Potash Corp. now sees earnings per share of 15 to 25 cents for the second quarter, and 60 to 80 cents for the year.

It added that it has cut production and spending plans.

BOJ holds the line

The Bank of Japan put some juice in the yen, and took the steam out of the Tokyo stock market, with a surprise decision today to hold the line on stimulus.

While many observers had expected more, central bank chief Haruhiko Kuroda chose to do nothing.

“The BOJ inaction suggests a desire to ignore the market response to January’s move into negative rates, and wait and see the effects of the policy change,” said Kit Juckes, the chief of foreign exchange at Société Générale.

“That’s not going to diminish the sense that the BOJ is almost out of ammunition, despite falling equities, falling [consumer price index], and soft retail sales data.”