Consumers confidence slumped last month to its lowest level since the summer as British households expressed concerns about the prospects for the economy next year.

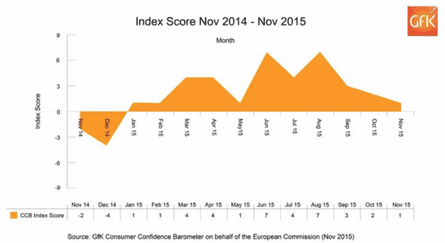

The GfK consumer confidence index dropped one point to +1 from the previous month and a high of +7 in July, after respondents said the prospects for the global economy had weakened.

The market research company’s survey echoed a poll by YouGov/Cebr, which said its consumer confidence index dropped by 0.7 points from September and now stands at 113.6 – its lowest figure since June.

A spokesman for GfK said that while consumers have benefited from the boost to disposable incomes from rock-bottom inflation, falling fuel prices and higher wages growth, “confidence appears to be depressed by a combination of wider economic, political and social events”.

Since the summer, when China signalled that its strong growth of previous years was beginning to wane, stock markets have remained volatile. Figures showing global trade and the forecasts for global growth have fallen.

Signals from the European Central Bank that it will need to embark on a third major stimulus of the eurozone economy and warnings of an interest rate rise in the US have also unnerved markets.

Scott Corfe, associate director at the Cebr economic consultancy, said: “These are uncertain times for UK consumers. The economic picture is still quite blurry, with positive news – such as encouraging employment figures – usually matched by an unwelcome development – like the increase in the UK’s budget deficit in October compared with a year ago.

“This flux is perhaps reflected in November’s consumer confidence measures, with many people growing more worried about the future. Consumer confidence is still relatively high, but it is not without its fragilities.”

The falls in consumer confidence came as the CBI reported that the services industry improved in the three months to November, but at a slower pace than seen in the previous quarter.

The business lobby group said the volume and value of consumer services – which includes hotels, bars, restaurants, travel and leisure firms – saw steady and strong growth.

Weaker growth was experienced by business and professional services – which includes accountancy, legal and marketing firms. They expanded at the slowest pace since 2013.

While cost pressures eased in this sector, they rose at the fastest pace in eight years across consumer services firms.

Rain Newton-Smith, director of economics at the CBI, said: “The UK services sector’s good run continues, and it’s encouraging that business volumes are expanding across the board, and that companies still expect healthy growth in profits.

“Employment growth is expected to slow a little in the quarter ahead, and given concerns over a lack of skilled workers – remaining close to a seven-year high in business and professional services – companies are increasingly looking to invest in new technologies that could raise their productivity.”

Comments (…)

Sign in or create your Guardian account to join the discussion