Illinois Department of Revenue: Progressive tax would lead to job losses, out-migration

The Illinois Department of Revenue has projected losses of 20,000 private-sector jobs, 43,000 residents to other states on net, and $1.9 billion in GDP in the first four years of a progressive tax.

A new fiscal note attached to Rep. Lou Lang’s progressive tax plan, House Bill 689, indicates that the pain of a progressive-tax scheme will be measured not just in tax dollars but also in job losses, out-migration and lost opportunities for Illinoisans.

Fiscal notes are like price tags for legislative bills: They estimate the costs, savings and revenue gains or losses resulting from the implementation of proposed legislation. Crafted properly, fiscal notes can provide a wealth of information elected officials need to make fully informed votes.

The fiscal note attached to Lang’s tax proposal comes from the Illinois Department of Revenue, and predicts the following effects:

Over the next four years

- Loss of 20,000 private-sector jobs

- An additional net loss of 43,000 people to out-migration (Illinois’ current net loss rate is 100,000 per year, so this tax plan would exacerbate those losses)

- Loss of $1.9 billion in gross domestic product

By 2030

- $2.8 billion less per year in disposable personal income compared with baseline trajectory (i.e., the state’s predicted economic performance without the proposed tax hike), a loss of $583 in disposable income per household

- GDP loss of $1.7 billion compared with baseline trajectory

- Job losses of 18,000 compared with baseline trajectory

- Population and labor-force losses compared with baseline trajectory

Illinois’ baseline trajectory is already bleak. The state’s economic performance has been anemic, and the state’s economic future does not look strong absent serious tax and regulatory reforms. A tax plan that would further weaken Illinois’ economic situation would be a perverse accomplishment for the General Assembly.

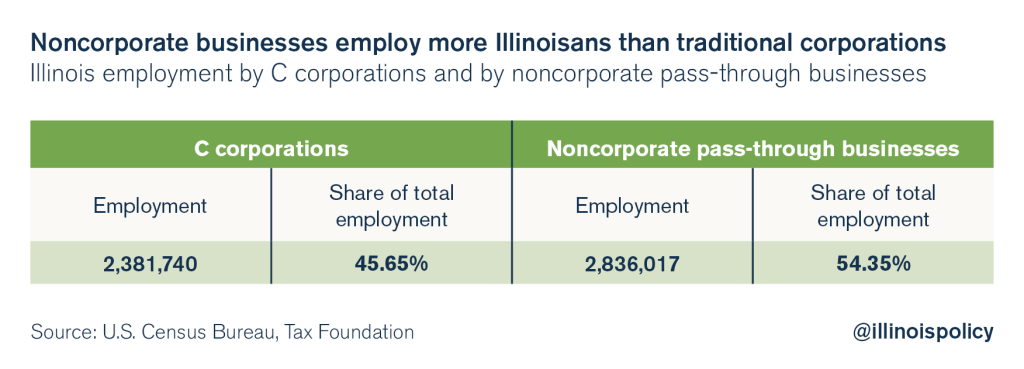

It’s not hard to see why the progressive-tax plan would have the negative effects cited by the Department of Revenue. Job losses and out-migration would naturally result from the imposition of such an extreme tax-rate hike on the enterprises that generate so much of Illinois’ small-business growth. Small businesses employ a majority of Illinoisans who work in the private sector, and Lang’s proposal would hit those responsible for most small-business income with much higher rates.

Small businesses employ 54 percent of Illinoisans who work in the private sector, compared with corporate businesses, which employ 46 percent of Illinois’ private-sector workers.

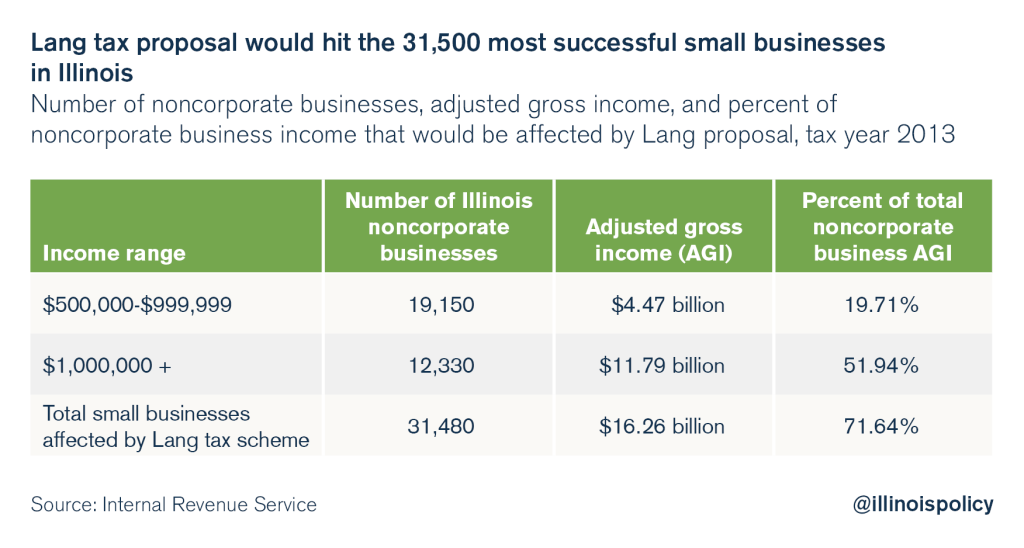

The most successful small businesses are the very ones that would be hit by Lang’s proposal. Illinois’ 31,500 most successful small businesses are responsible for 72 percent of all small-business income in Illinois, and Lang’s plan targets those businesses specifically for much higher tax rates.

Slapping a massive tax hike on the type of small businesses that generate the majority of Illinois’ private-sector jobs, and then specifically targeting those that produce nearly three-quarters of all small-business income with dramatically higher tax rates is a clear plan to cause job losses. This logic lines up with the Department of Revenue’s fiscal note about projected job losses due to the progressive-tax scheme.

The projected effects on migration are just as logical and straightforward. The tax plan would aggravate the outflow of wealth that is already at worrisome levels for Illinois. Specifically:

- Chicago is the only American city experiencing significant millionaire flight, and has the third-worst loss of millionaires in the world, according to a wealth-tracking research group.

- Higher-income Illinoisans are already leaving the state, on net, and taking significant wealth with them, according to the IRS.

Illinois already has the worst out-migration rate in the region, with a net loss of more than 3 percent of state population due to out-migration to other states over the last five years, according to U.S. Census data.

And the states that already attract the most people and wealth from Illinois, in particular Texas, Florida and Indiana, would gain an even bigger tax-competitiveness advantage in attracting small businesses from Illinois if Lang’s plan were to become law. Successful small businesses in Illinois would be hit by state income-tax rates as high as 11.25 percent, compared with 3.3 percent in Indiana and 0 percent in Florida and Texas.

With taxpayer flight already underway from Illinois to these states, it’s no mystery why the Department of Revenue projects that a progressive-tax plan would make the outbound lanes even busier.

Illinoisans have already suffered painful job losses, and have seen too many friends leave for states with more welcoming tax and jobs climates. For the sake of Illinoisans who run successful small businesses, and for the huge number of workers who find their opportunities with those enterprises, Illinois lawmakers should reject Lang’s wrong-headed tax scheme.