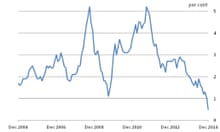

Mark Carney finds out this week if he will be the first governor since Bank of England independence in 1997 to write an open letter to the chancellor explaining why inflation is so low.

An oil market slump, a supermarket price war and a freeze on household utility bills is widely expected to have brought December inflation down below 1% for the first time since June 2002.

Under the Bank’s remit, if inflation strays more than one percentage point in either direction from the 2.0% target the governor must write to the chancellor explaining why inflation is off target and what the central bank intends to do about it. All of the 14 letters written until now have been after inflation missed the target too far in the other direction, overshooting by more than 1 percentage point.

Inflation on the consumer price index (CPI) measure fell to a 12-year low of 1% in November. Official figures on Tuesday are expected to show it dropped further in December.

Economists are forecasting inflation of just 0.7%, according to the consensus in a Reuters poll. The drop will not come as any surprise to the Bank’s monetary policy committee (MPC) which said in its November inflation report that inflation was likely to fall below 1% in early 2015.

“The lower oil price is amongst the factors that are set to push CPI inflation as low as 0.7% year-on-year this month,” said Sam Hill, senior UK economist, RBC Capital Markets.

“It is almost certain to be the first time in the MPC’s history that inflation has missed the target on the downside by more than a percentage point, requiring a letter of explanation from the governor.”

The UK is widely expected to avoid the fate of the eurozone, where all-out deflation was confirmed last week, but inflation is seen remaining low for some time meaning the Bank of England will be in no hurry to raise interest rates from their record low of 0.5%.

The thinktank Capital Economics predicts December inflation will come in as low as 0.5%.

“Admittedly, there is a risk that the number is slightly stronger, if weak core inflation in November was a symptom of temporary discounting. That said, we still think inflation will drift lower over the coming months, as the effect of the fall in oil prices fully passes through,” it said in a preview note.

Overall, the fall in inflation, which has halved over the last year, has been portrayed as good news for the economy, bringing relief to households squeezed by slow wage growth and rising bills.

Motorists have been cheered by falling fuel prices and the prospect of £1 a litre at the pump thanks to crude oil more than halving since last summer.

Last month, Carney said lower oil prices were largely positive for consumers and should support economic growth in the UK.

Low inflation and falling costs are cited on Monday in a survey suggesting UK businesses were at their most optimistic for three months in December and continued to hire new workers at a steady rate. UK businesses expect to grow in the first half of 2015, buoyed by low inflation, according to the latest business trends report by accountants and business advisers BDO.

But a separate poll chimes with other recent indicators suggesting the economy lost momentum at the end of last year.

As the global economic outlook clouded, business growth slowed and hiring moderated in December across England and Wales, according to the latest Lloyds Bank regional purchasing managers’ index (PMI). However, companies reported that cost pressures had eased, largely reflecting lower fuel bills and falling commodity prices.

The index measuring overall business activity across England fell from 57.7 in November to 55.9 in December, pointing to the slowest pace of output growth for a 18 months.

Tim Hinton at Lloyds Banking Group commented: “Firms across England and Wales remain in expansion mode, but there are signs that the recovery slipped down a gear at the end of 2014. Global economic uncertainty is affecting firms’ confidence to invest and ability to grow, but falling oil prices may start to ease cost pressures for companies and help support consumer spending in the months ahead.”

Comments (…)

Sign in or create your Guardian account to join the discussion